The commonest style of non-conforming loan is really a jumbo loan, which is a home finance loan that exceeds the conforming loan Restrict. Lots of lenders supply jumbo loans for quantities around $two to $three million.

Money improvements is often capped at several hundred to a couple thousand pounds, Nonetheless they’re speedy and simple to have. Should your credit card features a PIN, simply just check out an ATM to withdraw.

All Credible marketplace lenders present fixed-level loans at competitive fees. Mainly because lenders use various approaches To judge borrowers, it’s a good idea to ask for own loan prices from many lenders so that you can Look at your choices.

25 million in fines for supposedly violating borrowers' CARES Act rights. The CFPB statements which the lender misled borrowers in search of CARES Act forbearance and denied them critical protections furnished by the pandemic-era law.

An FHA mortgage loan is usually the most beneficial mortgage for a primary-time customer. FHA home loans appeal to people today whose finances aren't in the top condition still, since the minimum amount credit score necessary to get one is 580.

Look at your credit report: Have a look at your credit report to make certain there isn't any glitches on it. If you discover problems, dispute them Using the credit score bureau.

A longer expression may have additional inexpensive payments from thirty day period to month, but you’ll be in financial debt for a longer time period and fork out extra interest. Think about what repayment phrases do the job on your funds even though also maintaining curiosity expenditures at bay.

Think about using a minimal-interest bank card. When your expenditure or purchase is often paid by using a credit card that includes a zero-curiosity marketing time period, take into account that to start with. But be certain that you could repay the harmony on a reasonable time frame to stay away from accruing large-desire, revolving debt.

The smartest thing you can do to develop good credit rating is by generating on-time payments on debts you owe. For anyone who is trying to improve your credit history score in advance of implementing for just a property finance loan, decreasing your credit score utilization also can support Raise your rating.

What is homebuyer aid? Chevron icon It suggests an expandable part or menu, or at times preceding / following navigation possibilities.

Afterpay and Affirm are two purchase now, pay later on organizations that don’t charge interest on their own limited-expression payment ideas, but Afterpay may well cost a late payment payment.

What to look out for: New American Funding won't let you check out individualized charges without the need of providing Get in touch with information and facts. In addition, it rated small in J.D. Electricity's 2023 fulfillment examine.

You can do this by having to pay down charge card credit card debt you owe or requesting a rise on your credit history more info Restrict.

LendingClub could be a superior choice If the credit score rating wants perform. Each lenders offer a very online experience, but LendingClub considers applicants with FICO scores as low as 600.

Danny Tamberelli Then & Now!

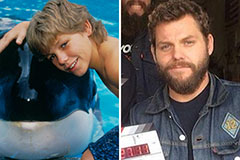

Danny Tamberelli Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Rachael Leigh Cook Then & Now!

Rachael Leigh Cook Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now!